Commercial real estate is pretty hot right now with significant development and construction going on all around us. As more businesses have been opening and expanding, commercial real estate prices have increased – due in large part to the cap rates. (If your business is booming and you’re thinking of buying commercial real estate and adding a location you might want to look back at this blog on adding a new location.) In this installment of JKB, we’ll take a quick look at what cap rates are and whether they’ll be changing anytime soon (in my humble opinion).

What is a Cap Rate?

It’s a commercial real estate term which stands for capitalization rate. While this is not the only driver of real estate value, it is one of the important ones, as it represents the rate of return that a property will produce based on income. If you’ve ever seen a commercial real estate appraisal, the property value was at least in part determined through an income-based calculation.

How is a Cap Rate calculated?

I know, you were told there would be no math. But calculating a cap rate is fairly simple. Just divide the net operating income of a property by the sale price/value. OK, you may not know the value of your real estate (in fact, that is what you are trying to figure out) so let’s take a look at a couple of components in trying to understand what drives and creates the cap rate.

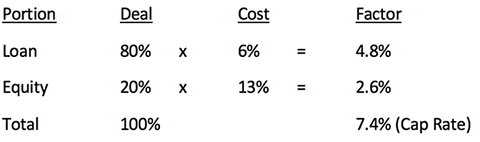

The components of cap rates, as they are used by most bankers and appraisers, are called bands of investment. This is the simplified explanation. Most commercial real estate is purchased with some kind of loan. Here is an example of a building purchase putting 20% down and borrowing the rest of the money:

The Cost means the cost of that funding. A real estate loan for a building purchase would have a rate of about 6%, so when you multiply the percentage you are financing by the rate of that financing, you get 4.8%. On the equity side, this a little more subjective, and it is essentially the return on the cash you are using for the purchase. If it is a low risk purchase you may not need as much of a return. Think about it this way, if your purchase has the same risk as buying a US Treasury bond, then you could use ~3% as your cost. But it’s more than likely that your purchase will be riskier than that, so the cost will be proportionately higher.

Based on this example you can start to see that as interest rates creep up, both of the cost percentages will go up. As banks charge more interest, the equity cost increases and there will be more investments available at ever higher rates of return.

So what’s the tip?

In essence I think we might see cap rates start to trend up a little bit, which may start to reduce the value of commercial real estate (but it’s just a hunch… don’t quote me). Cap rates and values have an inverse relationship. This is intuitive just like the residential housing market – if rates go up, it gets harder to buy a house, and not as many people can afford to buy.

While it can be useful for your curiosity to put together cap rates for your properties, or to see where the cap rates are headed (and thus the value of your property), it may be useful to consult a professional for further advice before making any decisions based on current or potential future cap rates.

If you’d like more explanation about cap rates, how they’re calculated, or how they might apply to your business, stop by my office or give me a call and we can talk shop.