Alliance Bank is proud to join forces with the Independent Community Bankers of America® (ICBA) in partnership with the U.S. Postal Inspection Service on an initiative to help clients protect themselves from the growing threat of check fraud. In support of this initiative, Alliance Bank offers educational materials and personal guidance to ensure customers have the tools they need to safeguard their financial assets and respond if they experience check fraud.

“At Alliance Bank, we are committed to helping our customers stay informed and secure,” said Laura Myers, Retail Risk Officer. “Empowering our clients with knowledge about check fraud is essential. When an individual understands how fraudsters operate and how to spot red flags, they can take proactive steps to protect themselves and safeguard their financial well-being.”

Check fraud schemes often involve the interception and alteration of legitimate checks, resulting in millions of dollars in losses each year for consumers and businesses. One in five Americans have or know someone who has been affected by check fraud, according to a recent ICBA poll conducted by Morning Consult.

Alliance Bank and ICBA offer the following tips to help protect against fraud:

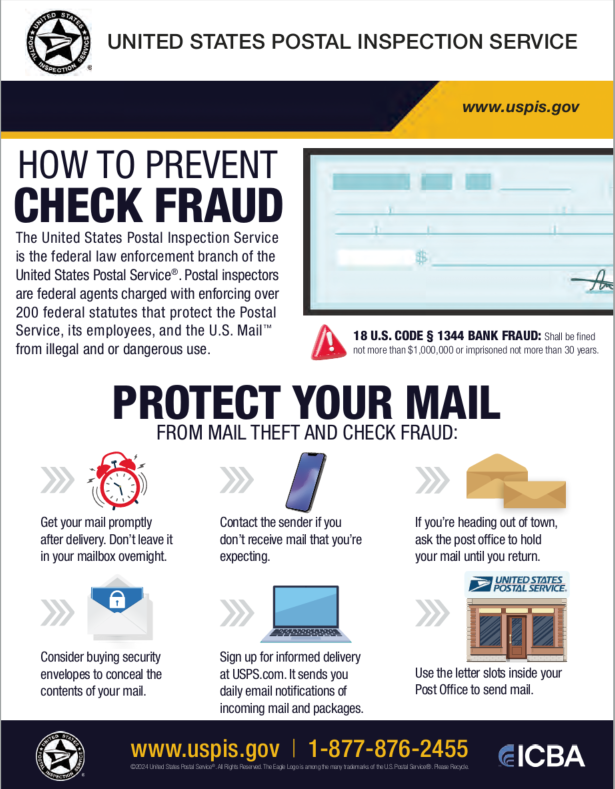

Tips to Prevent Check Fraud and Protect Mail

- Send checks securely using the letter slots inside your Post Office or by handing them directly to a letter carrier. Pick up your mail promptly and avoid leaving it in your mailbox overnight.

- Sign up for Informed Delivery at USPS.com to receive daily email notifications of incoming mail and packages.

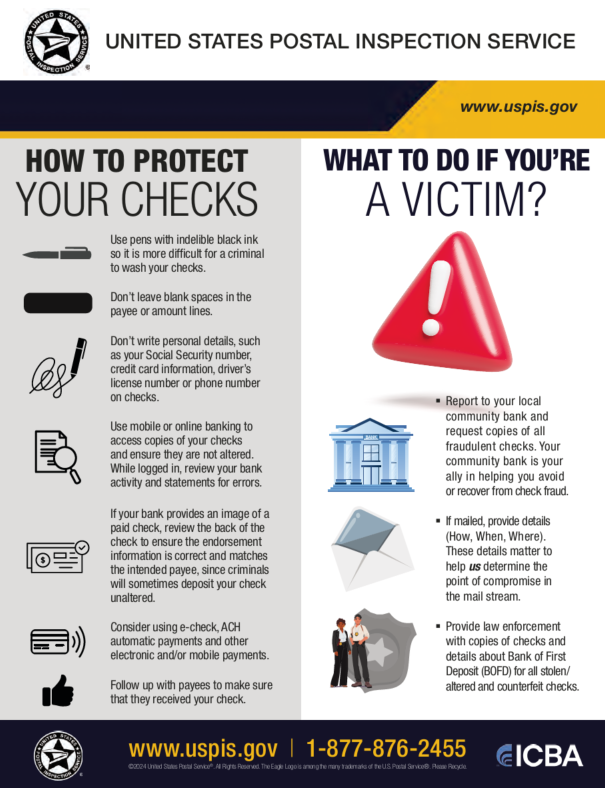

Additional Tips to Protect Checks

- Use pens with black gel ink and avoid leaving blank spaces on checks to reduce the risk of alteration.

- Monitor your accounts regularly using online or mobile banking and verify that checks reach their intended recipient(s).

Steps to Take if You Are a Victim of Check Fraud

- Report fraudulent activity to Alliance Bank immediately and request copies of altered or counterfeit checks for your records.

- Provide law enforcement with copies of fraudulent checks and details about how, when, and where the fraud occurred to assist their investigation.

“Community banks play a vital role in educating and protecting customers from financial fraud,” ICBA Vice President for Operational Risk and Payments Policy Scott Anchin said. “Through partnerships like this, we are equipping consumers with actionable information to prevent check fraud and reinforcing the trusted relationship they have with their local community banks.”

Clients are encouraged to contact their local Alliance Bank office if they ever suspect check fraud or would like further guidance to help protect their finances.